FHA Loans, the Basics

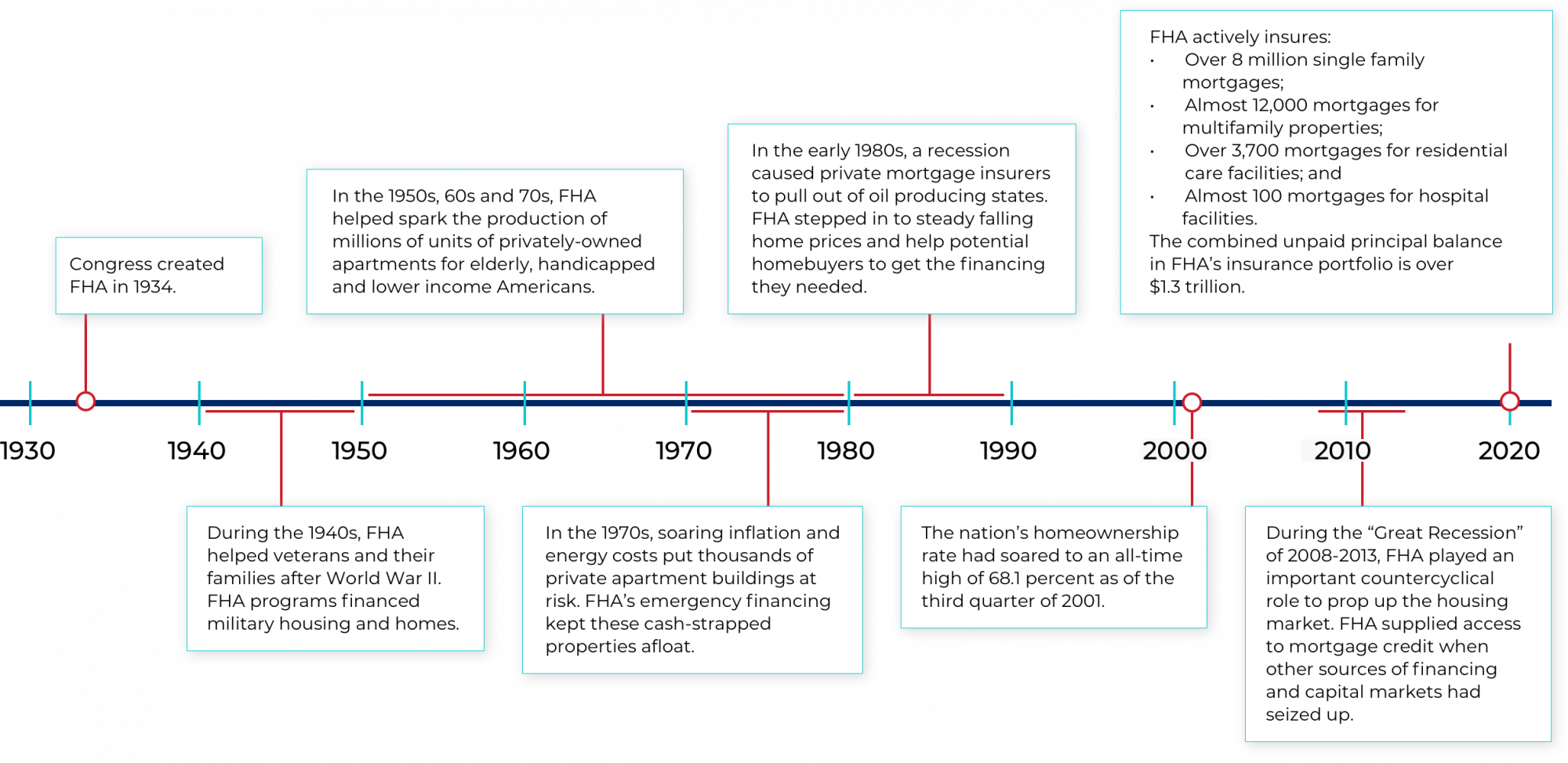

The dream of homeownership might seem daunting, especially for those with limited financial resources. However, the Federal Housing Administration (FHA) loan program is designed to make this dream more attainable. Enacted in 1934, the FHA loan program has been helping individuals who cannot make large down payments or have lower credit scores become homeowners.

What Is An FHA Loan?

An FHA loan is a mortgage that’s insured by the Federal Housing Administration. This type of loan allows lenders to offer loans with more lenient qualifying requirements, which include lower credit scores and smaller down payments compared to conventional loans. It’s an essential tool for first-time homebuyers and those with limited financial means. The basic eligibility involves a low down payment of as little as 3.5% and is insured for up to 96.5% of the home value.

Key Features Of FHA Loans

FHA loans come with features that differentiate them from other mortgage products:

- Lower Down Payments: Down payments as low as 3.5%, making it easier for buyers without significant savings.

- Mortgage Insurance Premiums (MIP): Includes an upfront MIP of around 1.75% of the loan amount and an ongoing annual MIP between 0.05% and 0.75%. This insurance compensates lenders for the higher risk associated with lower down payment lending.

- Various Property Types: Loans can be used for purchasing single-family homes, multifamily properties, and even hospitals.

- Special Loan Options: The FHA 203(k) Improvement Loan integrates the cost of certain repairs and renovations into the loan amount.

Benefits Of Choosing An FHA Loan

Opting for an FHA loan comes with several advantages:

- Accessibility: Easier qualification criteria compared to conventional loans, perfect for first-time buyers with lower credit scores.

- Fewer Restrictions: Higher acceptance rates for applicants with recent bankruptcies or foreclosures, provided they have demonstrated a responsible financial history thereafter.

- Competitive Interest Rates: Typically, FHA loans come with competitive interest rates, making monthly payments more affordable.

Drawbacks To Consider

Despite the appealing aspects of FHA loans, there are a few drawbacks:

- Mandatory Mortgage Insurance: Borrowers must pay both upfront and ongoing mortgage insurance premiums (MIP), which might add to the overall cost of the loan.

- Limited Loan Amount: There are caps on how much you can borrow with an FHA loan, which might be a limitation if you’re in a high-cost area.

- Property Standards: The purchased property must meet specific health and safety standards, which might require additional investment.

Is An FHA Loan Right For You?

FHA loans provide a pathway to homeownership for many who might not qualify for traditional mortgages. However, it’s essential to consider all aspects of this type of financing. If you’re looking for a home and need assistance with understanding your mortgage options, getting pre-approved, finding properties that qualify for FHA financing, and reaching out to a knowledgeable REALTOR® is a great first step.

Our dedicated mortgage team at Long & Foster is here to help you navigate the complexities of FHA loans and other financing options. With their expertise and personalized service, you can confidently make informed decisions and find the best mortgage solution for your needs.

Final Thoughts

If you’ve ever felt that owning a home was just a distant dream due to financial constraints or credit issues, know that the FHA loan program is designed to help people like you. With its low down payment requirement and flexible qualification criteria, the FHA loan program is a powerful tool that can turn your dream of homeownership into a reality.

The home-buying journey might seem daunting, but you don’t have to do it alone. Work with professionals who can guide you through your options and help you find the perfect path to owning your home.

Best wishes and best of luck!

R.D.